Content discovery remains one of the most pressing challenges for TV audiences, and it’s only going to escalate. That’s because the breadth of choice—the amount of content and the places to access it—are only going to grow over time.

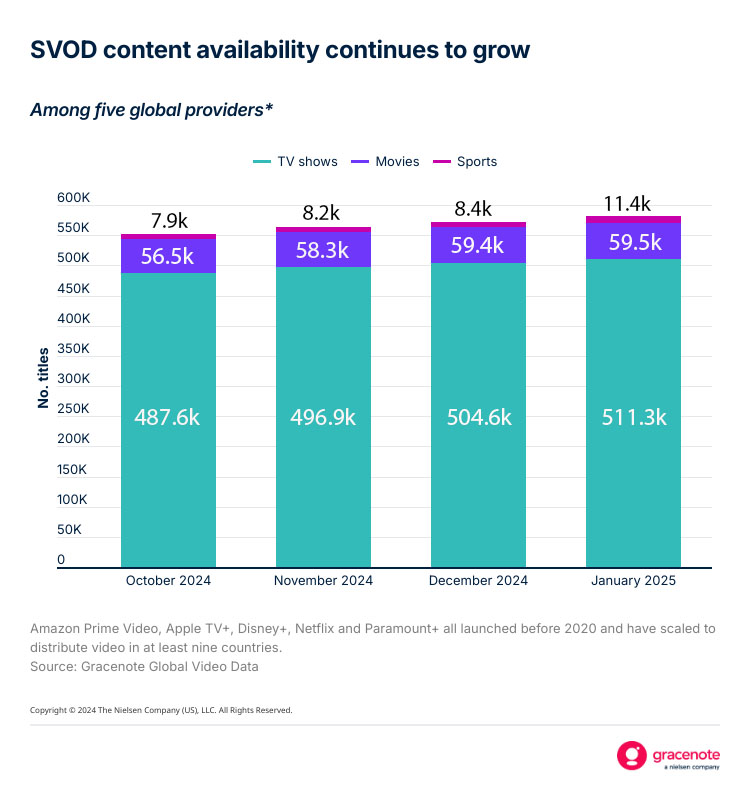

Between October and January 2025, for example, the five dominant SVOD providers1 added nearly 30.3k programs, movies and episodes to their catalogs, boosting the amount of available programming by 5.3% to nearly 582.3k shows and movies.

The perpetually growing abundance of content amplifies negative sentiment from audiences about the difficulties associated with finding something to watch. This is especially problematic when viewers start searching without having any idea of what they want to watch. Mid-2024 research from TiVo2, for example, found that only 15.5% of people in North America and 16% of people in the U.K. know what they want to watch when they start a streaming session.

The difficulty in finding the right content is affecting churn rates, as Deloitte’s 2024 Digital Media Survey found that 36% of Americans don’t believe the content on their SVOD services is worth the money they spend. Similarly, A Google-commissioned Harris Poll survey at the end of 2023 found that 48% of streaming subscribers cancelled a service because they couldn’t find something to watch.

Given the depth of content available on most SVOD services, it’s unlikely that the right content isn’t there. Rather, it’s more likely that the right content isn’t showcased prominently or recommended when it fits audience viewing preferences.

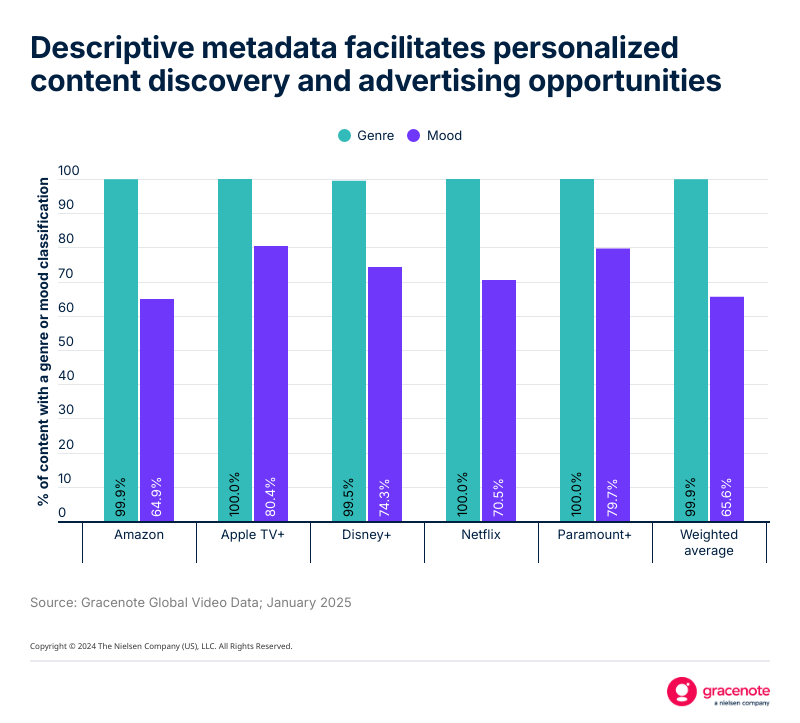

The underlying information about video content is key here, such as genre classification, program imagery, release year, production country and mood. At a high level, genre is table stakes: Within Gracenote’s global video database, 99.9% of the content that the five global providers distribute has at least one genre classification. Drama is the most prevalent genre across SVOD content, but genre alone isn’t going to help individual content discovery journeys.

Based on Gracenote Global Video Data, 24% of the SVOD content from the five global providers has a drama genre. Because genres are assigned at the program level (instead of at the episode level), this 24% equates to approximately 21.4k program titles (out of nearly 90k unique TV show, movie and sports programs). That’s enough to overwhelm even the most determined TV content seeker.

But there’s more to a program than just genre, so it’s unlikely that the presence of genre by itself provides enough information to help audiences know if they want to watch something. It’s also unlikely to help brands know if they should advertise within it.

When the metadata supporting video content is normalized and enriched, however, recommendations and search journeys can be more personalized and programmatic ad buys can be more targeted. For example, let’s look at two different TV shows that were included in Nielsen’s top 10 streaming list during the week of Nov. 18, 2024. Both are dramas and have a TV-MA rating, but the detailed video descriptor data for each program shows how different they really are from one another.

Given the wide range of content within any given genre, Gracenote has developed a rich set of video descriptors that are used to better describe individual programs. We developed 300 mood descriptors, for example, that can be used to fine-tune content discovery and enable contextual advertising opportunities. Of the shows and movies distributed by the five global SVOD providers, 65.6% had mood descriptors as of January 2025.

The implications of not maximizing content metadata are clear.

At a high level:

- A service / platform can’t properly categorize it.

- A service / platform can’t personalize content recommendations.

- Audiences may not be able to search for it.

- Viewers won’t know if they’d be interested in it.

- Brands won’t know if they want to advertise against it.

Given the growing abundance of content available to TV audiences, programming needs more than genre information to find the right viewers. While foundational from a metadata perspective, genre information lacks the specificity needed for platforms and services to help audiences find content that truly interests them—the biggest pain point they raise as SVOD platform options increase and content abundance magnifies.

Find out more about how our Advanced Discovery products can help your business.

Notes

- Amazon Prime Video, Apple TV+, Disney+, Netflix and Paramount+ all launched before 2020 and have scaled to distribute video in at least nine countries.

- Q2 2024 Video Trends Report; Q2 2024 Video Trends Report U.K.

Sports programming grew its footprint across the streaming landscape in 2025

While content libraries grow and distribution channels multiply, sports have become the hottest commodity across the streaming landscape.

How RAG and MCP differ in powering AI-driven TV experiences

RAG and MCP each address the limitations of LLMs, but they approach the issue in fundamentally different ways.

Missing metadata in FAST programming may be hindering ad revenue

FAST channels will become increasingly dependent on metadata to inform ad buys in programmatic systems.