The migration of live sports to streaming is still relatively young, but the pace of change has accelerated as streaming services seek to capitalize on the unwavering appeal of live sports—the program type that drives the most real-time viewing.

The competition to acquire lucrative sports rights, however, has affected the viewing experience in ways that are far more consequential than they are for other programs. Individual episodes from TV shows, for example, are rarely split across platforms. But that’s exactly what’s happening for sports fans.

Want to watch every episode of NCIS? Paramount+ has you covered. Looking for Grey’s Anatomy? You have options; both Netflix and Hulu have the entire catalog. Interested in Heartland? The series is available on an array of services, including Hulu, Netflix, Peacock, Tubi, Pluto TV and the Roku Channel.

Tracking the fragmentation of sports TV rights

Unlike a specific TV show, access to individual sports leagues and team games has splintered across more channels and services than audiences can keep track of. This has caused frustration, confusion and even a loss of interest. This trend is most prevalent in the U.S., but we are starting to see inklings of a-la-carte sports rights deals in other markets as well, including the U.K., Germany and Australia.

The NFL is the most profitable professional sports league in the world, so it makes sense that its TV rights are highly coveted by traditional broadcasters and streamers alike. As a result, NFL fans need an array of channels and streaming subscriptions if they want to catch all of the action in a single season. And fans who want access to out-of-market games need to buy an additional subscription through YouTube TV for league-wide action on Sundays.

Despite the channel fragmentation, keeping track of the games in an NFL season is relatively straightforward. That, however, is not the case with other leagues, especially those with lengthy seasons and those that don’t benefit from widespread national broadcast schedules.

The MLB falls into both of these categories: Each of the league’s 30 teams plays 162 games, giving fans 2,430 individual games to watch. And unlike the NFL, the vast majority of MLB games are not broadcast nationally. During the 2024 season, 150 games were broadcast nationally across traditional and streaming channels, leaving most of the league’s games dispersed across an array of regional sports networks (RSNs), local TV channels, streaming services and league-developed direct-to-consumer (DTC) subscriptions.

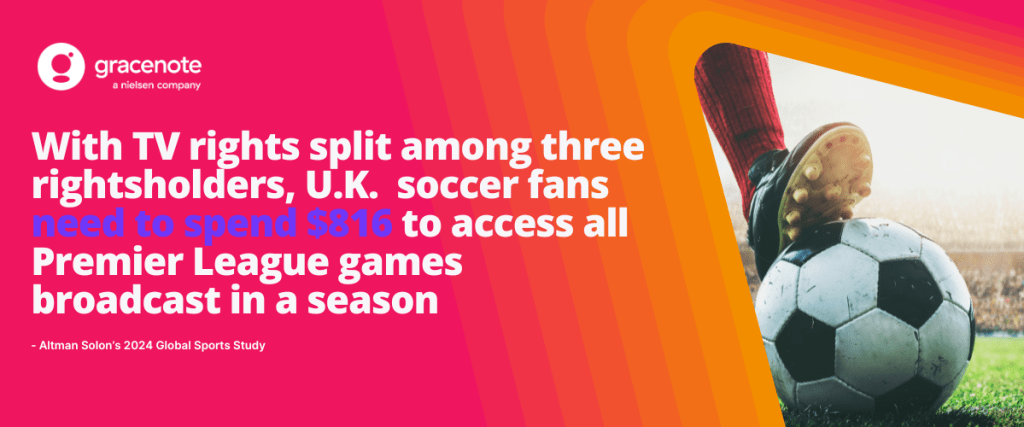

Outside of the U.S., fans of the Premier League in the U.K. currently need access to Sky Sports, TNT Sports and Amazon Prime Video to watch all televised matches. And Brazilian broadcaster Globo recently secured the exclusive rights to the home games of nine of the 20 teams within the Libra Group’s Serie A soccer league.

Not only does the splitting of TV rights become cumbersome for fans from a cost perspective, but the growing fragmentation has fans paying the ultimate price: not knowing where to find the games they want to watch.

Streaming usage is rising, but fans want new experiences

According to Altman Solon’s 2024 Global Sports Survey, 66% of fans struggle to access their favorite sports, but 56% say they would watch more if accessibility were improved.

Importantly, accessibility in this instance has nothing to do with internet connectivity or having the right device or service. In fact, TV audiences have never been more invested in their streaming services. In the U.S., 74% of U.S. households have an enabled smart TV and 84% have at least one subscription video on-demand (SVOD) service1.

We see the same shift elsewhere. According to Simon-Kucher’s 2024 global streaming study, self-paid subscriptions have increased to 3 from 2.4 per subscriber over the past year. That same study, however, noted that audiences now want more for what they’re paying for. Specifically, 54% plan to cancel for reasons related to content (e.g., not enough content, too much content, content quality), not price.

The “wanting more” sentiment is particularly pertinent for sports fans, especially as TV sports rights fragment. Not only do fans need to know where to find what they’re looking for, they need a great viewing experience once they tune in.

Recent research from Kantar highlights that value for the money now extends to content that is adjacent to live events: highlights, behind-the-scenes stories, stats and documentaries. The research concludes by stating that sports streamers need to do more than simply acquire the right content: They need to provide an engaging experience that builds long-term loyalty.

Delivering the sports experience fans want

Recent bundling initiatives among content providers seek to mitigate subscription churn and offset a-la-carte subscription costs, but they don’t address the more predominant challenge of knowing where a specific game is being broadcast. They also don’t solve the proliferation of fragmenting broadcast rights for live sports, which will likely continue going forward.

With the future of sports broadcasting set in motion, consumer electronics companies, pay TV providers and streaming services have a significant opportunity to give sports viewers what they want: access to everything they’re looking for.

Given the digital and app-driven state of today’s TV experience, a data feed is all that’s needed to provide an interface that tells sports fans exactly where a game is being played, as well as the ability to link to it—regardless of which channel or service is broadcasting it.

The same is true of providing well-rounded sports experiences. A dedicated sports data feed, combined with sports program information, provides all publishers with the ability to create sports hubs, integrate sports-related programming, showcase individual athletes and teams, incorporate real-time event schedules, scores and stats, and customize user interfaces for individual sports fans.

According to recent research from PWC, a new streaming era demands new data strategies. For sports consumption, the firm suggests that organizations adopt omnichannel approaches that concentrate on gathering insightful data about fans and then using it to boost viewership and engagement.

Given the trajectory of broadcast rights for live sports in the U.S. it’s likely that the unbundling of league and team rights will become more widespread over time, especially as streaming becomes more ubiquitous among TV audiences. This puts the onus of solving fan frustrations on the shoulders of the companies tasked with delivering the end experience. The upside is that metadata partners like Gracenote have the program and sports data streamlined and normalized to easily solve the frustrations that come with today’s sports programming landscape.

Click here to learn more about Gracenote’s On Sports product, which provides content platforms with the data they need to provide great sport content experiences, including helping fans find the games they want to watch.

Sports programming grew its footprint across the streaming landscape in 2025

While content libraries grow and distribution channels multiply, sports have become the hottest commodity across the streaming landscape.

How RAG and MCP differ in powering AI-driven TV experiences

RAG and MCP each address the limitations of LLMs, but they approach the issue in fundamentally different ways.

Missing metadata in FAST programming may be hindering ad revenue

FAST channels will become increasingly dependent on metadata to inform ad buys in programmatic systems.