Content distribution trends in the streaming industry continue to evolve, and an increasing number of popular TV shows are being made available on multiple subscription video on-demand (SVOD) services. In just the last few months, for example, shows like Your Honor, Dexter, Prison Break and The Resident have all found new audiences on multiple platforms. The cross-platform availability of these shows, however, highlights an entirely different trend: an underutilization of exclusive content.

There’s certainly no denying the importance of offering viewers high-quality and engaging content. But, there’s also no mistaking the importance of deep content catalogs: SVOD originals accounted for just one-fourth of time spent streaming last year1.

Through the lens of business investment, recent viewership trends suggest that many SVOD services might not be getting their money’s worth from the majority of the content they distribute. That’s because many of the TV shows attracting the biggest numbers are available on multiple services.

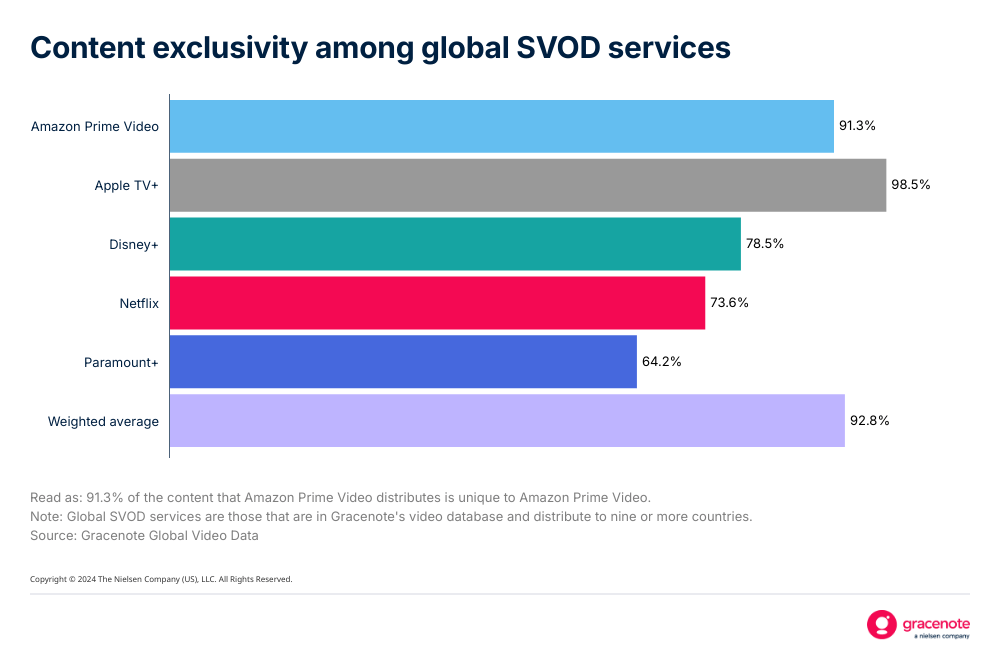

To better understand SVOD catalogs with respect to viewership trends, Gracenote recently conducted an analysis to identify content exclusivity at the platform level. The analysis found that 93% of the content that the five global SVOD providers2 distribute is exclusive to only one service.

The downside here is that it appears that viewers aren’t actively engaging with that content. Data from Netflix’s latest What We Watched Report, for example, shows that 68% of its TV shows and 73% of its movies had fewer than 1 million views3 in the first half of 2024. Separately, a review of time spent with streaming content during 2023 found that nearly 3,000 programs had zero minutes of viewing4.

At the provider level, Amazon Prime Video is the most focused on exclusive content, as it distributes 67% of the exclusive programming that the five global providers collectively offer. Given the notable differences in catalog sizes across the five global providers, however, analyzing content exclusivity is more equitable at the platform level.

A catalog-by-catalog analysis shows that Apple TV+, which has the smallest catalog of the five global providers, has the greatest percentage of exclusive content, followed closely by Amazon Prime Video, which distributes the most content.

From a business perspective, most SVOD services should be well-positioned for success. That’s because TV shows drive the most viewership5 AND account for the overwhelming majority of their existing catalogs. In fact, TV programs (including individual episodes) represent 89% of the content available to streaming audiences globally.

The gap between available content and engagement with it highlights a fundamental difference between scheduled, organized programming and unscheduled, on-demand and widely dispersed programming. The result? Audiences are overwhelmed and unsure how to find what they’re looking for.

The real downside in this scenario is that consumers have become sensitive to the costs associated with their subscriptions, which is driving up churn rates. So even though 47% of streaming users say they would spend more time streaming6 if it was easier to find content, a recent Google study found that just as many have canceled a service because they couldn’t find something to watch.

This is where a service’s user experience and metadata usage becomes critical. Not only can a user’s experience help differentiate a service that offers similar content from another, it can help better connect audiences with the content they’re looking for. How? Use the data about video, such as genre, mood, theme—even personalized images—to ensure individual programs are recommended to the right audiences.

Streaming services have transformed the TV landscape over the past 15 years and captured global audiences along the way. Now, they need to keep them. Success on this front, especially as new options gain momentum, hinges on maximizing catalog depth and personalizing audience experiences. Not only is the appetite among viewers evident, but the immense exclusivity at the catalog level presents a strategic way to engage—and keep—new and existing audiences for the long term.

For additional streaming distribution insights, download our latest State of Play report.

Sources

- Nielsen National TV Panel.

- The five global SVOD providers are the U.S.-based services that launched before 2020 and have scaled to distribute video globally and are tracked in at least nine countries within Gracenote’s video database.

- Netflix defines a “view” as the total hours watched divided by the total runtime.

- Nielsen Streaming Content Ratings; U.S. P2+.

- In 2023, licensed TV shows accounted for 42% of time spent streaming.

- Deloitte 2024 Digital Media Trends survey.

Sports programming grew its footprint across the streaming landscape in 2025

While content libraries grow and distribution channels multiply, sports have become the hottest commodity across the streaming landscape.

How RAG and MCP differ in powering AI-driven TV experiences

RAG and MCP each address the limitations of LLMs, but they approach the issue in fundamentally different ways.

Missing metadata in FAST programming may be hindering ad revenue

FAST channels will become increasingly dependent on metadata to inform ad buys in programmatic systems.