The 66th season of the Eurovision Song Contest is here, and if previous years are any indication 2022 will be another heavy hitter when it comes to viewership. But at the same time, the international music competition also provides insight into the emotions of the audience—through the mood of the songs they vote to win.

In addition to boasting seasons that have attracted more than 180 million viewers each year for the last seven years1, Eurovision’s international audience of music enthusiasts eagerly look forward to rooting for their favorite artists—and discovering new music.

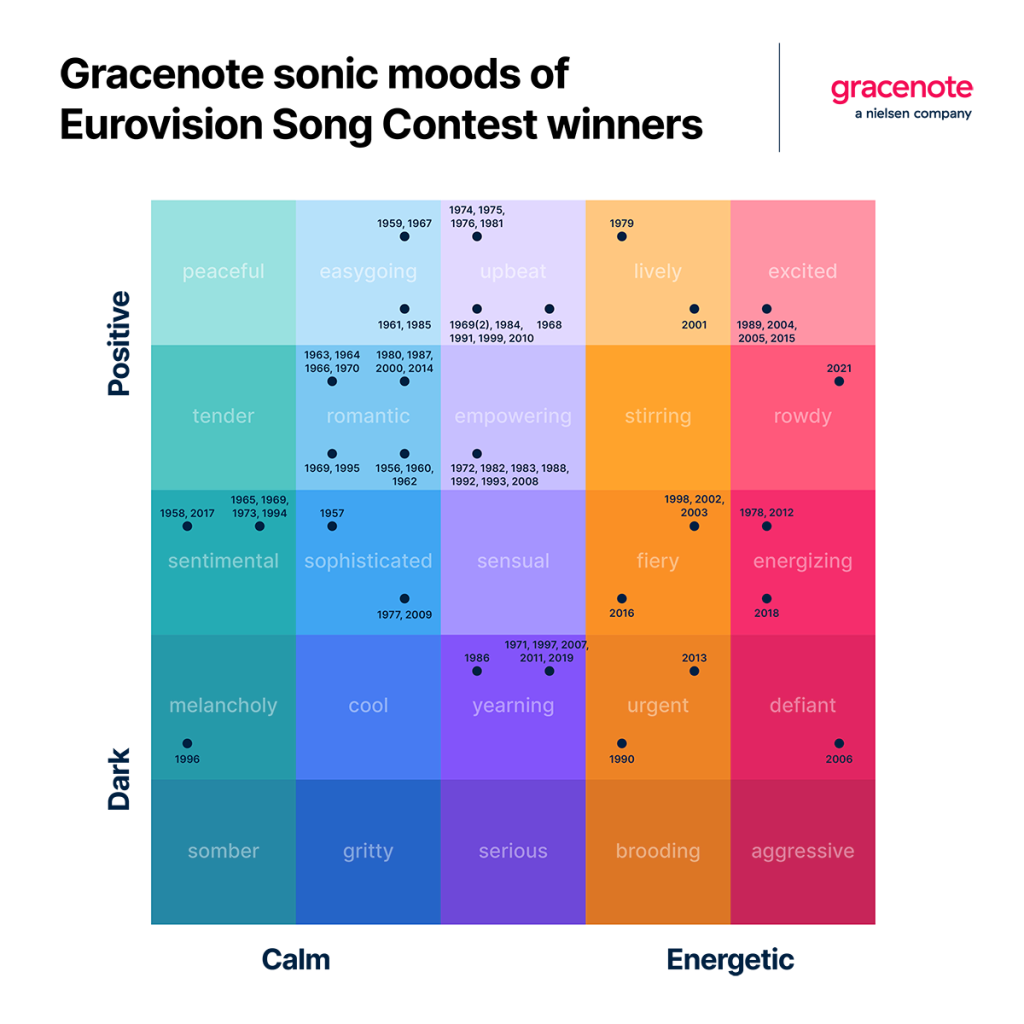

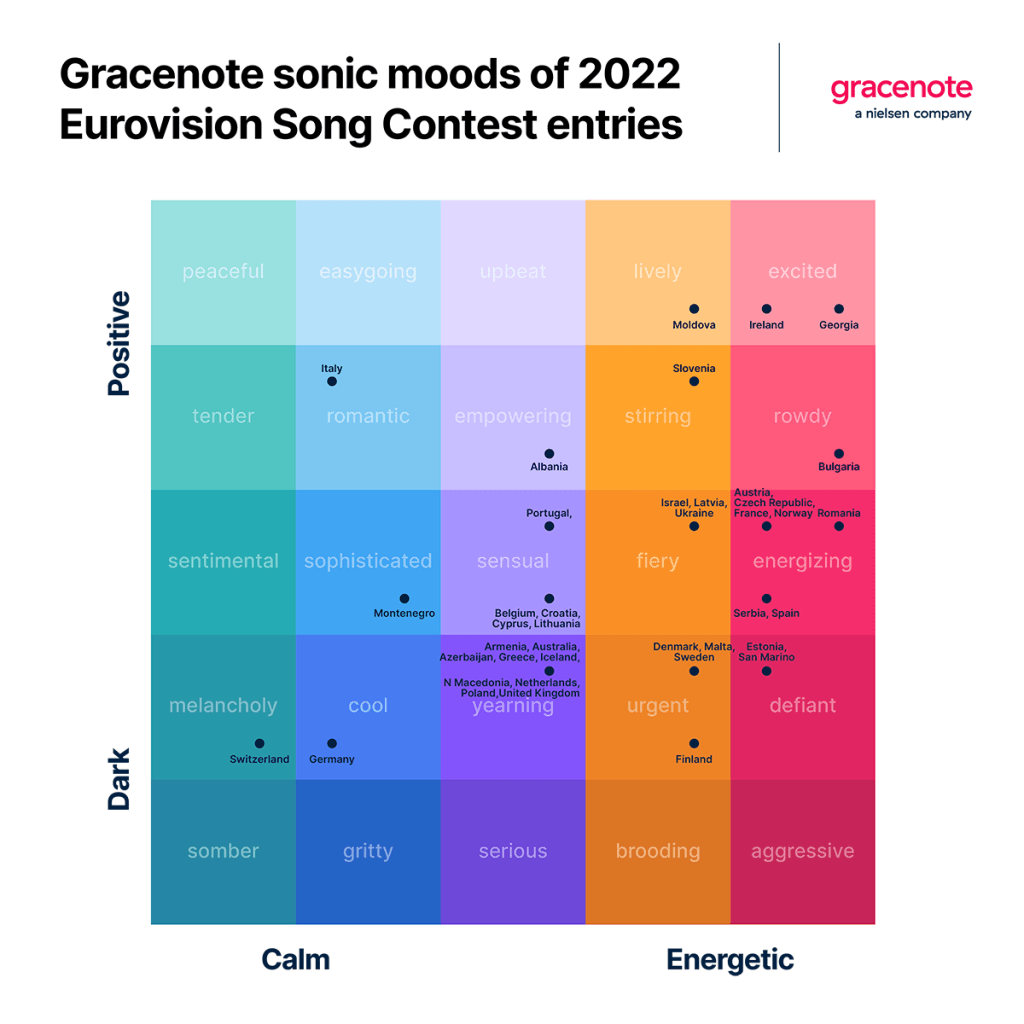

And with the variety of music being presented at this year’s contest, audiences will be able to find a song to suit virtually every mood—because the performers showcase more moods with each new year of competition. According to Gracenote Global Music Data Sonic Descriptors sonic mood analysis of previous Eurovision contests, recent Eurovision winners have displayed far more emotional range than their predecessors. The 40 songs presented at this year’s contest represent 15 different primary moods. And the last 15 winners have represented 12 primary moods, while only 11 moods were represented among the winners of the entire first 40 years of the competition.

The recent uptick in emotional diversity isn’t surprising—consumers are increasingly looking for experiences that engage with them as individuals, and creators are rushing to fill the gap. American television, for instance, now features 817,000 unique program titles across traditional TV and streaming services, compared with just over 646,000 titles in 20192. For musicians and streaming services looking to reach and engage new audiences, Eurovision trends can be a finger on the pulse of global audiences and their moods.

And according to this year’s choices, audiences are looking for performers to energize and soothe them. Twenty song finalists—half the field—feature more energetic moods, despite this category being a less-common winner. An additional seven entries feature calmer moods, including submissions from Italy and the Netherlands—two favorites to win the contest this year. This bucks the trend of previous contests, but reflects a recent change in consumer sentiment.

Faced with mounting supply chain woes, increasing inflation and the war in Ukraine, consumer confidence is at its lowest since the pandemic3. It’s no wonder audiences are looking for music that uplifts and reassures them. And Eurovision artists are meeting the moment.

Contrast this year’s trends with last year’s winner: “Zitti e Buoni,” a song classified as rowdy—the first time such a mood has won the competition. At the time of last year’s contest, many countries were lifting their COVID-related restrictions, and consumer confidence in Europe was its highest since October 20183. Americans echoed this sentiment, as a Nielsen custom consumer sentiment study found that in June of 2021, 90% of consumers said they were “ready to go” and get back to normal. Before the omicron spike later in the year, audiences were enthusiastic about emerging from over a year behind doors—and the choice of winner reflects their eagerness.

The benefits of striking the right chord with audiences don’t stop when the contest ends. And much like we see in other high-stakes competitions, Eurovision artists often see success far outside the competition. Out of 68 winning Eurovision songs, 46 have ascended to Billboard’s Top 100 U.K. Singles Chart4. And the 1976 winner, Brotherhood of Man’s “Save Your Kisses For Me,” spent 16 weeks on the chart, six of which were in the No. 1 spot.

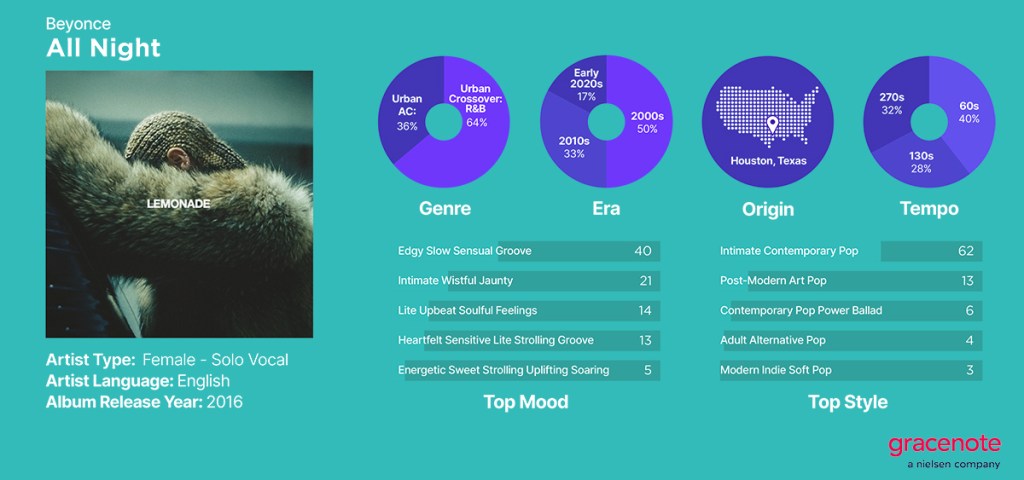

Artists aren’t the only ones who can benefit from understanding and anticipating audience moods. Streaming music services can use sonic mood data to create richer playlists and stations featuring a wider range of artists that exposes listeners to different styles of music and artists that they may not have discovered on their own.

Making it easy for audiences to find new songs and bands they’ll love is key. Applying hyper-detailed meta descriptions, like mood, to audio content help draw connections between genre, mood, era and tempo to create a more complete listener profile. This data enables nuanced discovery paths and offers audio recommendations that align with a listener’s current taste while providing them with carefully curated new options.

Notes

- European Broadcasting Union.

- Gracenote Global Video Data, February 2022.

- The Organisation for Economic Co-operation and Development (OECD).

- Billboard.

*This article originally appeared on www.nielsen.com.

Streaming has viewers captive in a fractured CTV landscape

Streaming viewers have become overwhelmed by choice and fragmentation. This sentiment is mounting, and it has a range of downstream effects.

The streaming paradox: More content has led to less satisfaction

Viewer frustrations are on the rise as streaming service congestion increases, highlighting opportunities for improved UX and content discovery.

Streaming service congestion is fueling an uptick in FAST channel engagement

As streaming options proliferate, engagement with FAST channels is on the rise, with news and sports becoming top genres.