As audiences continue to shift more of their TV time to streaming services, subscription video on-demand (SVOD) providers are adjusting their video catalogs to keep pace with demand. And based on a review of the content available to TV audiences, SVOD services are focused on delivering what drives audience engagement: sports and TV shows.

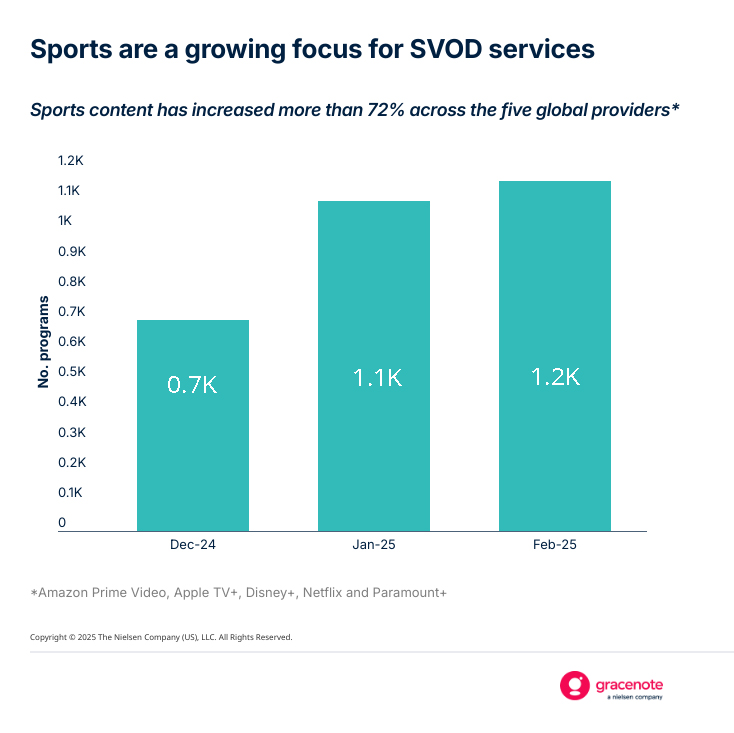

While SVOD services continue to add all types of programming to their video libraries, the importance of sports content is growing across the industry’s leading services. In aggregate, Amazon Prime Video, Apple TV+, Disney+, Netflix and Paramount+1 increased their collective sports programming by more than 72% since the end of 2024.

Disney remains focused on a streamlined user experience, most recently evidenced by the integration of ESPN+ into Disney+, which follows last year’s integration of Hulu as a dedicated tile within the streaming hub. Disney is also hoping to increase engagement with ESPN+ by offering select ESPN sports programming to Disney+ customers, resulting in a 471% increase in sports content on Disney+ in the recent quarter.

Sports programming within ESPN+ increased as well, rising 4.4% since October 2024 (8.3% growth when individual TV episodes are counted). Amazon Prime Video, Netflix and Paramount+ increased their sports catalogs by 9.8%, 98.6% and 4.4%, respectively. Apple TV+ did not grow its sports catalog during the period, but that will change with the start of the MLB and MLS seasons.

TV programming remains dominant on SVOD services

TV shows and their deep episodic catalogs remain the primary attraction across SVOD catalogs, accounting for 86% of all content available across Amazon Prime Video, Apple TV+, Disney+, Netflix and Paramount+.

The focus on episodic TV content makes sense from an audience engagement perspective: U.S. TV audiences spent more than 495 billion minutes watching the top 10 most-watched original and acquired TV shows on streaming platforms in 20242.

In the recent quarter, the five global SVOD providers added more than 2,000 TV shows to their catalogs (excluding individual episodes). Yet while these additions provide audiences with more TV titles to choose from than they did in Q4 2024, the amount of total TV episodes has declined.

Comparatively, the number of individual episodes available was notably higher in December 2024 and January 2025. The reduction in episodes likely reflects an increase in more recently produced content. New shows, particularly those made in the last few years, often include fewer episodes than shows made in earlier decades. Season 1 of the FOX show Tracker (premiered in 2024), for example, includes 13 episodes, whereas season 1 of CBS’ NCIS (premiered in 2003) includes 23 episodes.

Somewhat interestingly, the seasonal availability of holiday movies between November and January did not leave streaming audiences with fewer movies after the New Year. Collectively, the five global SVOD providers consistently added movies each month between October and February, leaving audiences with just over 3,000 more movies than at the start of Q4 2024.

At the platform level, Disney+ and Paramount+ now offer fewer movies than in October (11.9% and 6.9% less, respectively), while Amazon, Apple TV+ and Netflix accounted for the aggregate increase, adding 7.9%, 59.6% and 0.6%, respectively.

From an audience engagement perspective, sports generate big numbers, and not just for marque events like the Super Bowl. NBC’s primetime coverage of the 2024 Olympics was up 13%, including a 39% spike for Peacock, the 2024 MLB postseason had a six-year high and the coverage of last year’s WNBA season across Disney channels and ION was up 201%.

The audience appeal makes the broadcasting rights for sports very competitive, and an increasing amount are being earmarked for streaming services: Netflix streamed two NFL games on Christmas in the lead up to Super Bowl LIX, the NHL has a new deal with Warner Bros. Discovery that includes streaming rights for Max via its Bleacher Report sports add-on and the latest NBA rights deals include an 11-year exclusive with Amazon Prime Video for 66 regular season games and all the knockout rounds from the league’s in-season tournament3.

With all of this unfolding, the distribution of sports programming will remain a hot topic for years to come.

For additional insights about video distribution trends across global SVOD services, visit Gracenote’s Data Hub, which is updated quarterly.

Notes

- These five U.S.-based SVOD services launched before 2020 and have scaled to distribute video in at least nine countries.

- Nielsen Streaming Content Ratings.

- Nielsen audience measurement.

How RAG and MCP differ in powering AI-driven TV experiences

RAG and MCP each address the limitations of LLMs, but they approach the issue in fundamentally different ways.

Missing metadata in FAST programming may be hindering ad revenue

FAST channels will become increasingly dependent on metadata to inform ad buys in programmatic systems.

Streaming has viewers captive in a fractured CTV landscape

Streaming viewers have become overwhelmed by choice and fragmentation. This sentiment is mounting, and it has a range of downstream effects.