The availability of new content is always welcomed by audiences and advertisers alike, especially after the strikes in Hollywood sidelined production for most of last year. Yet despite the influx of new programming that audiences will have access to this year, the business reality of content today is clear: An overabundance of content doesn’t automatically equate to higher ROI.

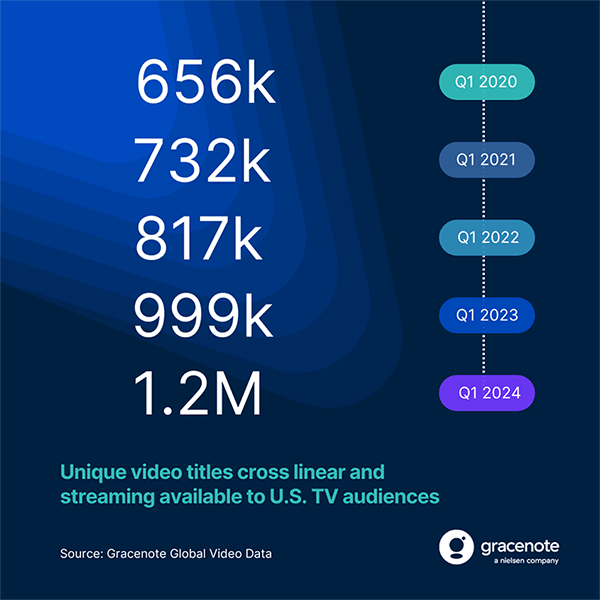

Case in point: U.S. TV audiences have about twice the content available to them than they did five years ago, but they still spend an average of 5 hours per day with TV1.

An array of factors have contributed to the demise of peak TV2, including high production costs, streaming monetization challenges, cord cutting, and extensive platform fragmentation. As a result, fewer TV programs are being produced.

According to Gracenote’s Studio System database, 1,308 TV series3 are slated to air this year across linear and streaming channels. That represents a year-over-year drop of 36% and a 52% decline from 2022.

Production pullbacks notwithstanding, audiences still have more content choice than they could ever watch in a single lifetime. Production pullbacks have, however, inspired a new take on an old favorite in the traditional TV world: content syndication.

While we saw shifts in distribution strategies last year to cover the gaps resulting from the strikes in Hollywood4, broader changes appear more permanent and operationally strategic. Specifically, very little programming is exclusive to a single network or streaming service:

- Only 21.4% of U.S. streaming titles are exclusive to individual services.

- Only 12.8% of U.S. linear TV titles are exclusive to specific TV networks/channels.

While classic TV programs like I Love Lucy, the Johnny Carson Show and Sanford & Son are no stranger to wide distribution deals (especially on FAST services), some of the most-watched streaming programming is following suit.

Six of the licensed titles in Nielsen’s top 10 streaming list for the week of July 8 were available on two different streaming services (i.e., audiences can watch Grey’s Anatomy on Hulu and Netflix). Young Sheldon, another popular streaming title, is available on three services. Comparatively, each of the licensed titles on the list during the week of Jan. 1, 2023, were exclusive to one service.

Cross-channel distribution is also becoming more inclusive of FAST services, particularly among companies with large film and TV libraries. Warner Bros. Discovery, for example, has licensed an array of popular TV titles to Tubi, Amazon Freevee and the Roku Channel over the past year, allowing audiences to watch shows like Cake Boss, Say Yes to the Dress, Westworld and the Bachelor on the platform of their choice. Engagement with FAST is also growing, as Pluto TV, Tubi and the Roku Channel accounted for a combined 4.3% of total TV use5 in June 2024.

What does this mean for the future of TV?

Here are some implications for audiences, publishers and advertisers:

Audiences

Audiences are cutting back on their subscriptions, so the pivot away from content exclusivity will heighten the prospect of churn among consumers looking to consolidate further—especially if they’re not finding what they’re looking for. Search and discovery journeys are key factors here.

- Our 2023 State of Play report noted that 20% of people don’t know what they want to watch and ultimately give up their search and do something else entirely.

- Hub Entertainment Research’s most recent Conquering Content report notes that 61% of survey respondents say they are more likely to choose a service that makes discoverability easy, up from 56% a year earlier.

Publishers

Networks and streaming services will need to prove their value with audiences in ways other than just what programming they offer. This is especially true when programming is not exclusive. Publishers that use metadata to reduce consumer frustration and cultivate loyalty with personalized experiences will be better positioned for long-term success amid rising competition.

- Amazon Prime Video’s recent interface update aims to simplify user experiences with more personalization while simultaneously helping users understand which content is included in their subscriptions and what costs extra to watch.

- The recent integration of Hulu into Disney+ involved the re-encoding all of Hulu’s video files to ensure homogeneity within the broader, single library system of Disney+. The result is one master library with consistent metadata, descriptions and playback, all of which aids search and personalization.

- Publishers can also use personalized imagery to improve audience engagement.

Advertisers

As audiences settle in with their networks and services of choice, brands have an opportunity to improve their engagements with viewers by leveraging content metadata to inform their creative, reach target audiences and align with brand values.

- With privacy a key consideration for digital marketers, contextual video data provides media buyers with an opportunity to leverage program genres, ratings, content types and advisories to inform their programmatic CTV buys.

- When advertising is paired with complementary content, audience attention leads to higher resonance, favorability, recall and loyalty.

The ongoing shift to streaming has put the audience in control like never before, and the breadth of choice continues to expand, both in terms of content and channels. With that much choice, however, viewers are finding it hard to find just the right content. And in some cases, they might not know that certain titles are available.

A review of the most-watched streaming programs of 2024, for example, found that nearly 3,000 streaming titles6 had zero minutes of viewing. Well-deployed metadata strategies will go a long way in ensuring that audiences know which titles are available and how to find them.

Notes

- Total time with TV includes time with live, time-shifted and CTV content; Nielsen National TV Panel.

- Peak TV is a term used to describe the era of unsustainable growth in the number of scripted programs produced across a variety of platforms. The term was coined in 2015 by FX Networks CEO John Landgraf.

- As of Aug. 13, 2024.

- Examples: Paramount Global began airing Yellowstone on CBS, and the Walt Disney Co. aired all Monday Night Football games on ABC and ESPN.

- Nielsen’s The Gauge.

- Nielsen Streaming Content Ratings; U.S. P2+.

Sports programming grew its footprint across the streaming landscape in 2025

While content libraries grow and distribution channels multiply, sports have become the hottest commodity across the streaming landscape.

How RAG and MCP differ in powering AI-driven TV experiences

RAG and MCP each address the limitations of LLMs, but they approach the issue in fundamentally different ways.

Missing metadata in FAST programming may be hindering ad revenue

FAST channels will become increasingly dependent on metadata to inform ad buys in programmatic systems.