TV audiences should have no reason to complain. They have access to more video content that they could ever watch, and they can watch it whenever they want. Even so, viewer frustrations are building.

After trading one consolidated cable bill for what has become an array of apps, logins and interfaces, many viewers are having trouble keeping track of it all. Despite a decade’s worth of familiarity with CTV, this scenario reflects the reality that the growing range of content options has viewers overwhelmed—and without a guide.

Not only are unsatisfactory content searches inconvenient for TV viewers, they represent a significant threat to audience satisfaction and retention. Notably, a recent Gracenote survey of streaming consumers in six countries1 found that nearly half would consider canceling a service because they can’t find something to watch.

And what’s more troubling is that nearly one-third say the congestion of services and content is having a negative effect on their TV enjoyment.

The high cost of “What should I watch?”

For streaming services, publishers and distributors, the primary goal is engagement. Gaining that engagement, however, isn’t as straightforward as it once was. In some respects, the abundance of content and content providers has become a significant headwind.

The surplus of content amid growing channel fragmentation is the culprit here, and it affects viewers who don’t know what they want to watch as well as those who do. In addition to the 25% of TV viewers who say they often can’t find a specific program, more than one-third say they don’t know what they want to watch when they turn on their TVs. Among viewers aged 18-24 and those in the U.S. and U.K., the percentage is notably higher at 45%.

As a result, viewers are spending an average of 14 minutes looking for something to watch. In France, it’s nearly double at 26 minutes. This poses an increasing risk for content distributors, especially those that charge subscription fees. In addition to the risk of cancellation, one-in-five viewers say they frequently abandon their searches and do something else entirely. The percentages are notably higher among younger viewers and viewers in the U.S. and the U.K.

Live sports: Fragmentation magnified

Unlike a typical TV show, which is usually available on a specific channel or service, the broadcasting of live sports has become far less straightforward.

Given the massive engagement that live sports attracts, it’s a big driver for global subscription services2, which have increased their sports programming by 32% in 2025. Streaming viewers have taken note:

- More than half (51%) say they subscribe specifically to watch live sports; and

- 65% say they would likely subscribe to a new service if it offered the live sports they want to watch.

The only caveat: Fans need to be able to find the sports once they’ve subscribed.

CTV has caused the bulk of the fragmentation, which is even more challenging when it comes to finding live sports at the local level.

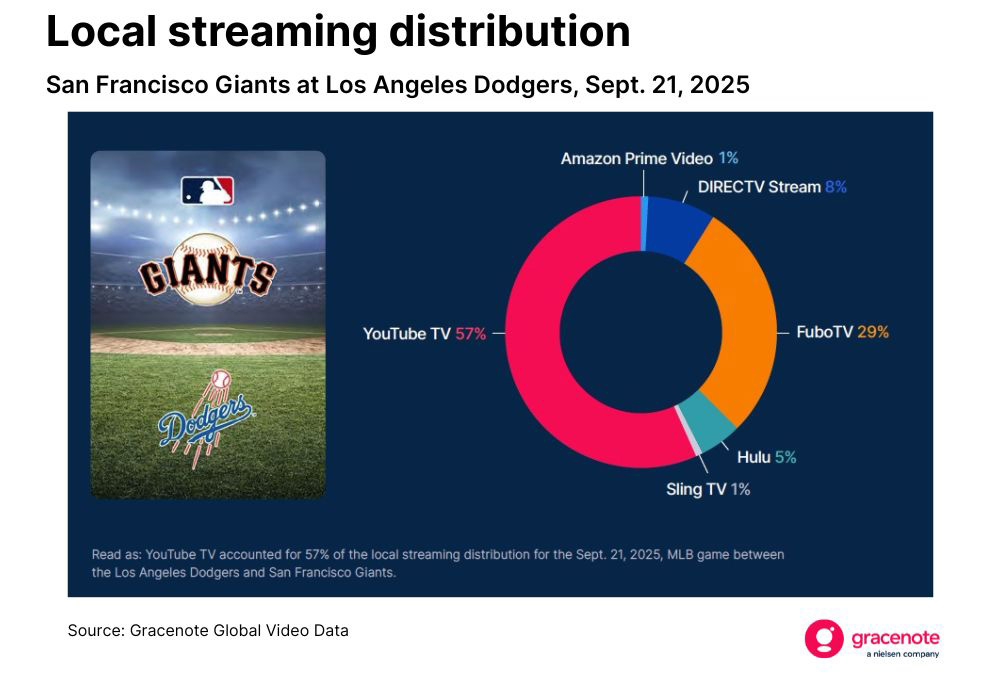

Here’s an example: On Sept. 21, 2025, the San Francisco Giants played the Los Angeles Dodgers. In addition to traditional linear television, the game aired live across 732 over-the-top (OTT) channels distributed to local markets by five vMVPDs. Many of these vMVPDs covered the same markets, but not all of them. In this situation, DIRECTV Stream, FuboTV, Hulu and YouTube TV distributed to the Chico, Calif., market, but Sling TV did not. Sling TV’s California distribution was limited to Los Angeles, San Diego and San Francisco.

Herein lies the challenge for viewers: Identifying which service or channel is carrying the game and then determining if they have access to it. The result is frustration, missed opportunities and negative sentiment toward the entire TV experience.

The solution: From content silos to a holistic experiences

The streaming landscape isn’t getting simpler. New services, FAST channels and OTT options continue to enter the market. In the U.S., for example, there are now nine different brands highlighted in the streaming portion of Nielsen’s The Gauge, and three of them cover multiple services3. When The Gauge launched in 2021, there were only five services4.

This trend will not reverse, and the solution to better content discovery is not less content.

Viewers love their streaming experiences, but they’re clear about what they need going forward: They want their services to tell them where to find specific programs. Future success in video distribution, especially as congestion escalates, will come to the publishers and services that best help audiences find their way to what they’re looking for quickly and with as little friction as possible.

Content remains king, but not if viewers can’t find it. In the new streaming era, the ability to seamlessly connect a viewer to content, wherever it lives, becomes the most valuable commodity.

For additional insights, download our 2025 State of Play report.

Notes

- Brazil, France, Germany, Mexico, the U.S., the U.K.

- Amazon Prime Video, Apple TV+, Disney+, Netflix and Paramount+

- Disney includes viewing on Disney+, ESPN+ and Hulu SVOD. Paramount includes viewing on Paramount+ and Pluto. Warner/Discovery includes viewing on Discovery+ and Max.

- At inception, streaming providers needed to account for 1% of TV usage to be listed individually in the Gauge.

Sports programming grew its footprint across the streaming landscape in 2025

While content libraries grow and distribution channels multiply, sports have become the hottest commodity across the streaming landscape.

How RAG and MCP differ in powering AI-driven TV experiences

RAG and MCP each address the limitations of LLMs, but they approach the issue in fundamentally different ways.

Missing metadata in FAST programming may be hindering ad revenue

FAST channels will become increasingly dependent on metadata to inform ad buys in programmatic systems.